Big local monthly market update for May - June 2018

Spring is feeling fairly normal so far. In fact, May was actually a pretty strong month. What a difference from the doom we felt in 2018. Let’s talk about it.

THE SHORT VERSION:

- Prices are up from the fall and it’s shaping up to be a strong spring

- Prices aren’t up much from last year

- There were more multiple offers this May compared to last May

- Sales volume has slumped for 12 months

- There are nearly 2,700 less sales this year

- So far the spring has felt fairly normal

- This post is long on purpose. Skim or pour a cup of coffee

THE LONGER VERSION:

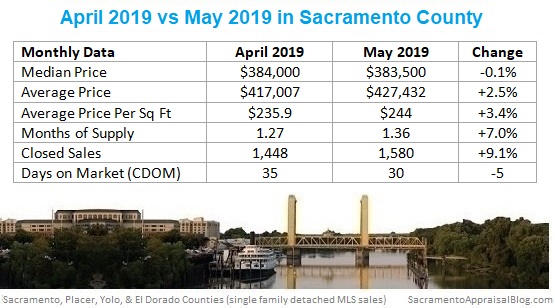

Normal: The stats for May were strong and showed what we’d expect to see for the month. Prices showed an uptick, inventory remained low, it took less time to sell, the sales to list price ratio increased, etc… In short, the market feels a bit normal right now. This doesn’t mean it’s perfectly healthy, but from a stats perspective it’s been fairly normal.

More multiple offers: We saw more multiple offers this May compared to last year at the same time. I know, it’s barely up, but all year the number of multiple offers has been lagging, so this shows us a strong spring has sprung.

Blackstone: I mentioned last week that Blackstone (Invitation Homes) is starting to sell some homes in Sacramento. For now it looks like they’re offloading some non-performing inventory, so that’s how I plan to describe it unless new information comes to light. Keep in mind lots of headlines talk about Blackstone selling, but these headlines refer to stocks instead of homes. If you didn’t know, in recent weeks Blackstone sold $1B of their stock in Invitation Homes. This is big news of course because it means Blackstone is clearly making a move to exit the market. But this doesn’t mean Invitation Homes is going to exit the actual housing market by dumping all 80,000+ homes they own in the United States. I’m doubtful this is their plan since Invitation Homes is such a well-oiled mega-rental machine. But we’ll keep talking about this as needed.

Blackstone: I mentioned last week that Blackstone (Invitation Homes) is starting to sell some homes in Sacramento. For now it looks like they’re offloading some non-performing inventory, so that’s how I plan to describe it unless new information comes to light. Keep in mind lots of headlines talk about Blackstone selling, but these headlines refer to stocks instead of homes. If you didn’t know, in recent weeks Blackstone sold $1B of their stock in Invitation Homes. This is big news of course because it means Blackstone is clearly making a move to exit the market. But this doesn’t mean Invitation Homes is going to exit the actual housing market by dumping all 80,000+ homes they own in the United States. I’m doubtful this is their plan since Invitation Homes is such a well-oiled mega-rental machine. But we’ll keep talking about this as needed.

Slower growth: Prices are up from last year, but they’re not up by much. The market feels really competitive, but we’re just not seeing insane price growth. Most metrics are up anywhere from 2-3% from last year. This reminds us it’s possible to have a really competitive market without insane price growth.

Highest sale ever in Sacramento County: There is now a $5M sale that just closed in the Sierra Oaks Vista neighborhood. It was a private sale and it’s the highest residential sale ever in Sacramento County. The ultra contemporary home was previously listed a couple times and here’s a video from Nick Sadek’s listing. I mention this because we are starting to see outlier sales like this pop up. This is a reflection of where prices are at, but it’s also a reflection of growing demand for the luxury market.

Michelin star: The big news locally is Sacramento got its first Michelin star for a restaurant called The Kitchen. Yesterday someone asked me if this star will affect property value in surrounding neighborhoods. I can comment later on that, but for now I have a Twitter poll going. Please vote.

Picky about getting into contract (and staying): I haven’t run stats on failure rate yet, but I hear from lots of real estate agents about buyers falling out of contract more often these days. I’ll have to run the numbers at some point, but I wanted to say it doesn’t surprise me to hear this. The reality is today’s buyers are incredibly picky about what they purchase. They’re choosy about condition, location, and price, so they take their time to get into contract. Moreover, since they don’t want to get stuck in a bad situation, if something doesn’t go right during an escrow, they’ll bail. Thus they’re picky about getting into contract AND staying in contract. Sellers, did you hear that? Buyers aren’t desperate.

A year of slumping volume: Sales volume in the region was strong for May and has rebounded substantially from a dreadful fall season, though technically volume has been down 12 months in a row in Sacramento County (and 13 months in the region). All things considered we’ve had 9% fewer sales, which means there have been 2,700 fewer homes sold this year. Keep in mind this is not the sign of a market meltdown, but it’s definitely safe to call this a slower year in terms of volume. This is something we have to keep watching. I suspect if rates go up, we could see volume slump again too.

Rates are doing the limbo: Rates keep doing the limbo by finding lower levels, and that tends to put a steroid in the market to create more competition. This is a big factor to watch since our market feels heavily influenced by the direction of rates right now. As a side note, if rates get really low it could lead to stronger price growth.

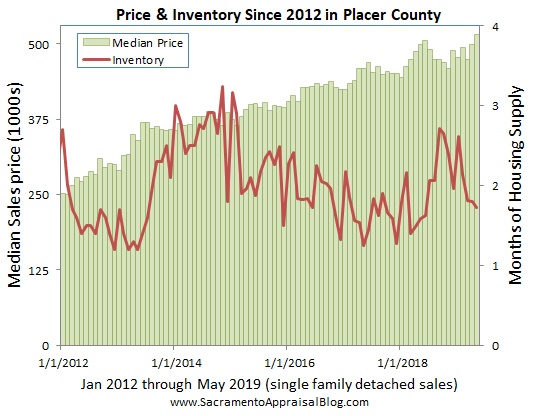

Getting back to the top: The median price in the region is now higher than the previous peak in 2005. It took us fourteen years to get back, which is the entire lifespan of my 8th grader. Anyway, in coming time we’ll surely have more “bubble” conversations because of this. But let’s be real. Many buyers are already wondering and having these conversations. Keep in mind the market in 2005 was much different than today and there is no such thing as a formula where the market “pops” when reaching 2005 levels. Technically, current values aren’t actually anywhere near 2005 when we consider inflation. But in my experience very few buyers actually think about inflation like this unless they’re statistics nerds. In case it helps, here’s a post I wrote about buyers worried about another housing bubble.

I could write more, but let’s get visual instead.

I could write more, but let’s get visual instead.

FOUR BIG ISSUES TO WATCH:

1) SLOWING MOMENTUM: Despite the spring market clearly heating up, stats show the market is slowing down when we look at the rate of change by year. So while we might describe the market as “hot”, we can also describe it as slowing.

2) LAST YEAR VS THIS YEAR: Check out the price metrics below. Can you see why I’m saying prices seem flat lately? This may not be true in every single price range or neighborhood of course, but this shows us price momentum is slowing. With that being said, it’s still okay to say the market is “hot”. It is. But I’d say competition is hotter than price appreciation.

3) SALES VOLUME SLUMP for 12 months: It’s important to look at sales volume in a few ways to get the bigger picture. Here it is by month and year.

SACRAMENTO REGION:

Key Stats:

- May volume down 4.6%

- Volume is down 9.2% over the past 12 months

SACRAMENTO COUNTY:

Key Stats:

- May volume down 6.1%

- Volume is down 8.3% over the past 12 months

PLACER COUNTY:

Key Stats:

- May volume is up 2.7%

- Volume is down 8.4% over the past 12 months

EL DORADO COUNTY:

Key Stats:

- May volume down 4.9%

- Volume is down 12.6% over the past 12 months

4) SPRING GETTING HOT: The market is heating up for 2019. We’re seeing price changes, low inventory, and increased sales volume.

NOTE: Take El Dorado County data with a grain of salt. Stats change significantly month by month.

SACRAMENTO REGION (more graphs here):

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO COUNTY (more graphs here):

PLACER COUNTY (more graphs here):

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

I hope that was helpful.

Courtesy of www.LundquistCompany.com